New Energy Economy Opposes Blackstone Takeover of PNM

“Now they want to own and gold-plate the grid to benefit private companies at PNM customer expense. Let me be clear: New Mexico will not be their next extraction colony.” — Mariel Nanasi, Executive Director, New Energy

Santa Fe, NM – New Energy Economy (NEE) announced today that it will intervene in the New Mexico Public Regulation Commission’s (PRC) review of Blackstone’s proposed $11.5 billion acquisition of PNM, NMPRC Case No. 25-00060-UT, warning that the deal fails the state’s six-factor public-interest test for public utility mergers and poses grave risks to New Mexico families, workers, and the environment.

Blackstone, the world’s largest private equity firm, has a long track record of putting profits above people in its portfolio companies — from spiking rents and evictions in housing, to surprise billing and understaffing in healthcare, to labor abuses and child. Its entry into New Mexico’s energy system would represent a direct threat to ratepayers and communities.

Under the PRC’s six-factor test, Blackstone fails:

- Customer Benefits: Blackstone has offered a rate credit of $105 million distributed over a 4-year period,[1] which sounds like a lot but comes out to approximately $3.51 a month for the average residential ratepayer,[2] and this includes NO rate freeze, a standard benefit in an acquisition of this magnitude. Without a rate freeze, the rate credits offered, are highly likely to prove illusory. Additionally, Blackstone will offer: $10 million over a ten-year period to the Good Neighbor Fund used to assist low-income customers; $25 million in investments focused on “innovative technologies”; and $35 million in financial support to drive “economic development”. However, Blackstone’s profit-driven model guarantees rate shock, with an acquisition premium of at least 23% that, in NEE’s opinion, will land on the backs of New Mexico families.

- Preservation of Commission Jurisdiction: Blackstone’s opaque corporate structure and history of self-dealing through affiliate transactions undermine transparency and regulatory oversight.

- Quality of Service: Evidence from Blackstone’s other ventures shows a pattern of cost-cutting, deferred maintenance, and degraded quality of care and service.

- Improper Subsidization of Non-Utility Activities: Blackstone’s interest in massive data centers and regional energy exports creates conflicts of interest. Rather than building community solar and microgrids to serve New Mexicans, Blackstone is likely to use PNM’s monopoly to subsidize its non-utility operations (i.e., selling our renewables to Arizona/California and building data centers).

- New Owner’s Qualifications and Financial Health: While Blackstone is financially massive, its business model prioritizes short-term profit extraction, not the long-term, stable clean-energy operation required of a regulated monopoly utility. Blackstone’s business model includes: investing money from public pensions and States to buy up companies, restructure them for maximum short-term profit, and squeeze every last dime out of workers, customers, and local communities. They buy nursing homes and staffing levels drop. They buy housing and rents skyrocket. They buy energy companies and climate goals are subordinated to investor returns.

- Customer Protections Against Harm: Blackstone’s track record in housing, healthcare, and energy demonstrates a disregard for protections, leaving customers vulnerable to disconnections, homelessness, and loss of essential services.

- [1] 80 percent of the rate credit is allocated to the residential class.

- [2] See, pdf page 432 of 721, Testimony of Henry Monroy, PNM Table HEM-2, p. 9., (a copy of page 9 is at the end of this press release).

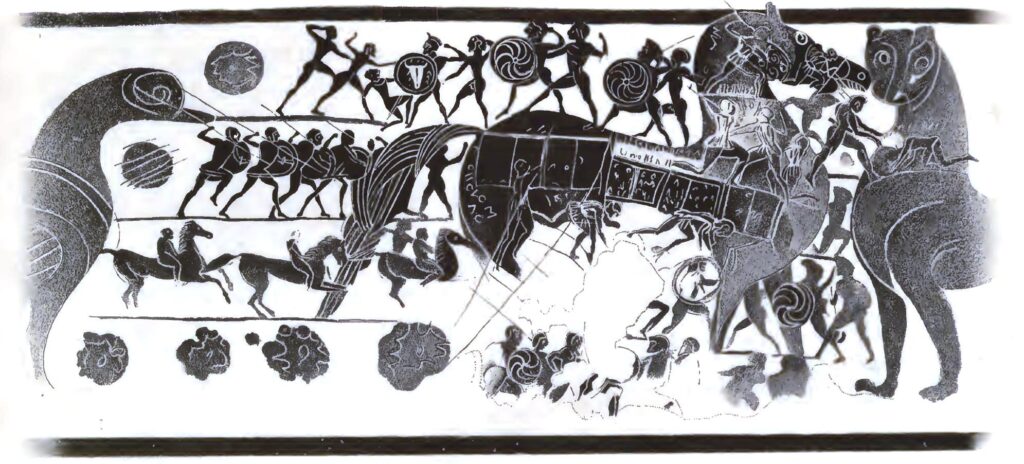

“Ironically, Blackstone is calling their participation in this acquisition “Troy ParentCo,” – the mission of the Trojan Horse, a ruse, was to destroy Troy from the inside – the Greeks had to infiltrate Troy to dominate and destroy.

The purpose of the Trojan Horse, a symbol of deceptive cunning, was to mislead and overrun the fortifications of Troy. Just like in the myth, Blackstone wants us to feel like there is divine intervention in the works, but there is nothing natural or inevitable about this acquisition.

Here, Blackstone is offering a Trojan horse to ratepayers, a deceptive gift, one that will ultimately dominate and destroy us if we allow them to enter New Mexico.

The largest private equity firm in the world owning New Mexico’s largest public utility might make Blackstone’s financial dreams come true—but it will cause rate shock for New Mexicans.

This is the same firm that acquired companies, including one that employed undocumented children to clean meat packing plants, that hikes rents and evicts families, that invests in data centers that consume enormous amounts of water and electricity at the expense of community.

Now they want to own and gold-plate the grid to benefit private companies at PNM customer expense. Let me be clear: New Mexico will not be their next extraction colony.” — Mariel Nanasi, Executive Director, New Energy Economy

New Energy Economy urges the PRC to reject the Blackstone takeover and instead pursue a future where New Mexico’s abundant renewable resources are developed responsibly for the benefit of its people—not for the profit of billionaires.

Part of Testimony of Henry Monroy, PNM Table HEM-2, p. 9., referred to in footnote [2], above.